Surveys Reveal the Present and Future of Music Consumption

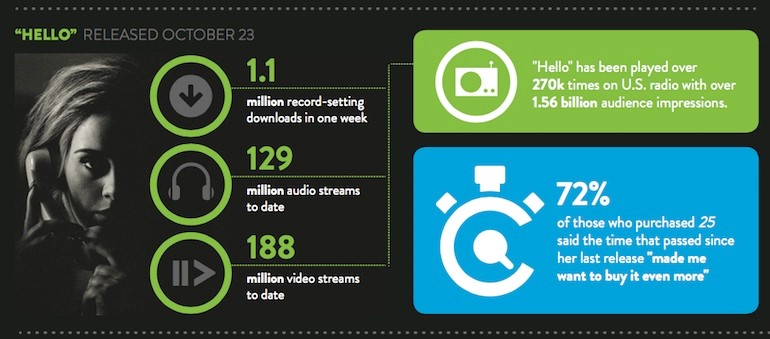

January 6, 2016 – If you were paying attention to the trends in 2015, album sales were down (unless your name is Adele) and audio/video streams of music climbed steadily, as Nielson’s just-released 2015 Music U.S. Report confirms. Unfortunately, most people still think premium music streaming services are not worth paying for, proving again that free music seems to be the generational payback that young people enjoy in exchange for the toxic world they’re being handed. On the plus side, vinyl sales continue to grow, and plenty of people are still shelling out significant cash to see live music.

See interesting bullet points from the 2015 Nielsen Music U.S. Report below.

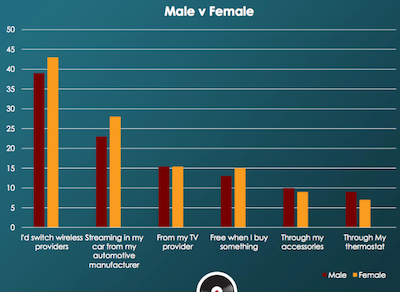

Meanwhile, at the gadget-centric Consumer Electronics Show (CES) going on in Las Vegas this week, the MusiComms consortium announced the results from its 2015 Year-End Survey. The survey asked more than 4,000 people randomly selected across all demographics how they would like to receive music in the future. They were told to choose their top three choices from the following options, listed in descending order of popularity. Response frequencies are in parentheses.

- “I will change mobile operators if they offer music package with my subscription.” (40%)

- “Free streaming from my car, as part of a service from my car manufacturer.” (25%)

- “From my TV provider, where I can download it from the TV to my phone.” (15%)

- “I will buy things if the companies offer a free music service with purchase.” (14.1%)

- “From my accessories, including exercise bracelets, earrings or sneakers.” (9.1%)

- “Through my thermostat, which is now an in-home speaker.” (8.2%)

- “Other” (3.5%)

The popular choices stayed consistently popular across age groups and genders. While these responses seem to confirm that people want easy access to all music and don’t want to pay a lot for it, they at least also show that people are open to a continually evolving music-delivery system, including alternatives that could explore new systems for compensating the rights holders through a cut of a larger paid product or service.

2015 Nielsen Music U.S. Report Highlights and Lowlights

- Adele’s 25 was the biggest selling album by far at 7.4 million sold in only six weeks; that’s 3.1% of all album sales for the entire year.

- Audio on-demand streaming was up 83% in 2015

- Vinyl LP sales grew for the 10th consecutive year--up 30% with nearly 12 million sold in 2015. 68% of those vinyl sales were for rock albums; 45% of those sales came from independent record stores.

- The Beatles catalog amasses 14 million streams in its first day of streaming availability from 12/24-12/25.

- Total album sales were down 6.1%, but total album consumption, including “track equivalent albums” and “streaming equivalent albums,” was up 15.2%.

- Digital track sales fell by 12.5%, while total audio/video music streams were up 92.8%.

- Rock was the most consumed genre, representing 24.5% of total album, track and stream consumption, followed by R&B/Hip-hop (18.2%) and Pop (15.7%).

- The top digital song seller was “Uptown Funk” by Mark Ronson/Bruno Mars, with 5.52 million sold.

- The top digital song streamer (audio+video) was “Trap Queen” by Fetty Wap, with 616 million streams.

- Radio (AM/FM & satellite) still reaches more American adults (93% every week) than any other platform and is still the biggest overall source for music discovery. Urban Contemporary radio had the best year among Millenials (18-34), growing 12% over 2014, but Pop Contemporary Hit radio still had the biggest 18-34 share: 12.4%.

- About 42% of total music spending goes to admission to live music events, which were up from 2014.

- Only 9% of respondents were “very/somewhat likely” to pay for a music streaming service in the next six months.

View the original article here.

About MusiComms™

MusiComms™ is a global initiative dedicated to collaboration between the music and communications industries with the goal of seeking out new opportunities for innovation and long-term sustainability and profitability of both markets.

As a consortium, MusiComms™ hosts a number of activities that bring together leadership from music and technology-driven industries to develop, innovate and implement new revenue models and marketing opportunities, with the ultimate goal of leveraging music to distinguish brand and fuel business opportunities.

- Contact

- MusiComms

- Meredith Salefski, +1-615-864-7841

- meredith@smartmarkusa.com